Elite Wealth Advisors Ltd.

One point of contact for all financial needs, where focused on wealth creation for all the Investors.

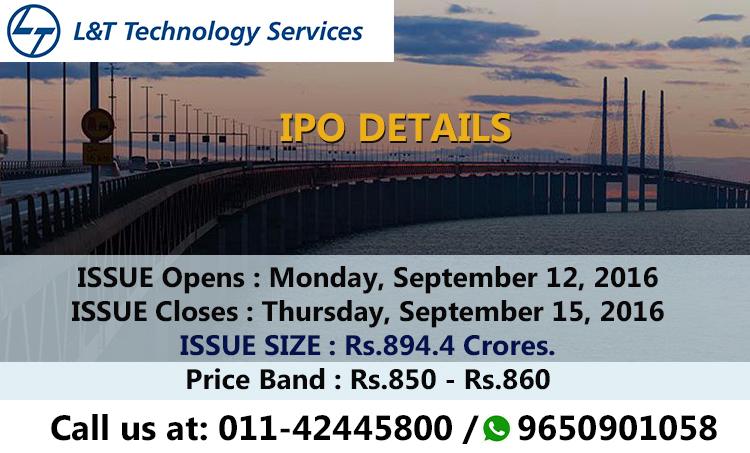

Larsen Toubro Technology Services Limited IPO Details

L&T Technology Services Limited is the leading global pure-play ER&D (Engineering, Research and Development) services company. Company provide ER&D services, which is defined as the set of services provided to manufacturing, technology and process engineering companies, to help them develop and build products, processes and infrastructure required to deliver products and services to their end customers.

L&T IPO Details:

- Issue Open: Monday, September 12, 2016 – Thursday, September 15, 2016

- Object: 1) The objects of the Offer are to achieve the benefits of listing the Equity Shares on the Stock Exchanges and to carry out the sale of up to 10,400,000 Equity Shares by the Selling Shareholder.2) The listing of the Equity Shares will enhance brand name and provide liquidity to the existing shareholders, as per the company.

- Price Band: Rs.850/- to Rs.860/- per equity shares.

- Bid Lot: 16 equity shares & multiple of 16 equity shares thereafter.

- Issue Size: Offer for Sale of 1,04,00,000 equity share by Larsen & Toubro Limited (Rs.884 crs @ lower price band & Rs.894.4 crs @ upper price band)

- Face Value: Rs 2/- each

QIB (including Anchor):-

50% of the Offer (Rs.442 crs @ lower price band & Rs.447.2 crs @ upper price band).

NIB:-

15% of the Offer (Rs.132.6 crs @ lower price band & Rs.134.16 crs @ upper price band).

Retail:-

35% of the Offer (Rs.309.4 crs @ lower price band & Rs.313.04 crs @ upper price band).

For More Details Visit us on http://elitewealth.in/Admin/docs/Larsen-Toubro-Tech-Serv-Ltd-IPO-Note.pdf or visit our research blog at http://research.elitewealth.in/blog/larson-toubro-lt-ipo-details-research-recommendation/

Monthly Stock Recommendations August 2016

Monthly Stock Recommendations of the month of August 2016: In the mid of Month of July we had advised conservative investors to book profit and aggressive investors can hold it till month end. So returns are based as per the recommendation.

For Daily Research, visit our website: http://www.elitewealth.in

or Subscribe our Research Blog: http://research.elitewealth.in

Monthly Equity Call performance July 2016

Monthly Equity Call performance July 2016

Total Profit of the Month - July 2016 is INR 3,34,524.36

For Daily Research, visit our website: http://www.elitewealth.in

or Subscribe our Research Blog: http://research.elitewealth.in

RBL Bank Ltd. IPO – Details, Listing, Allotment, Prospectus, Latest News

RBL Bank Ltd is one of India’s fastest

growing private sector banks. The Bank has cultivated a customer-centric

culture where they use their industry domain knowledge, experience and

technology with the goal of satisfying the client’s complete banking

needs. They offer a comprehensive range of banking products and services

customized to cater to the needs of large corporations, small and

medium enterprises (“SMEs”), agricultural customers, retail customers

and development banking & financial inclusion (low income)

customers. They have been expanding their presence across India through a

growing network of branches and ATM’s and upgrading their traditional

delivery channels with modern technology-enabled channels like phone

banking, internet banking and mobile banking.

Strengths:

- Client focused approach to business resulting in growing brand recognition

- Robust multi-channel distribution system

- Partnerships that expand their reach in rural markets

- Growing net interest and non-interest income

Key Highlights:

- Bank’s total income has grown from Rs 207.76Cr in Fiscal 2011 to Rs 2356.49Cr in Fiscal 2015, which represents a CAGR of 83.52% for the past four fiscal years.

- Their net profit after tax has increased from Rs 5.58 Cr in Fiscal 2011 to Rs 207.1 Cr in Fiscal 2015,which represents a CAGR of 146.75% for the past four fiscal years.

- Their deposits grew from Rs2042.15 Cr at the end of Fiscal 2011 to Rs17099.25Cr at the end of Fiscal 2015, which represents a CAGR of 70.10% for the past four fiscal years.

- Advances grew from Rs 1905.16 Cr at the end of Fiscal 2011 to Rs 14449.82 Cr at the end of Fiscal 2015, which represents a CAGR of 65.95% for the past four fiscal years.

Their branch network, which was

historically concentrated in south western Maharashtra and northern

Karnataka, has now expanded across India through a growing network of

branches and ATM’s. During Fiscal 2014 and Fiscal 2015, they opened 59

new branches across various states including in the key cities of

Kolkata, Delhi, Mumbai, Chennai, Bangalore and Ahmadabad. Their

distribution network included 348 interconnected ATM’s as of March 31,

2015.

In addition, they have digital banking

channels including mobile banking, internet banking and phone

banking/IVR. They have developed micro-payment and branch less banking

solutions as well as a business correspondent network to expand their

customer reach beyond the traditional branch service area.

For More Details Visit our blog: http://research.elitewealth.in/blog/topic/ipos/

Subscribe to:

Posts

(

Atom

)